Thoughtfully spend money to make money - FROM THE ARCHIVES

Business lesson 9 - when and how to invest in your business.

As we move in the fourth quarter of the year, here’s a post from the archives to provide some food for thought. Perhaps 2025 has been a banner year and you know you’re ready to invest in your business as you look to 2026. Or maybe you’re “that close” to being ready to expand your team and need guidance on when and how to spend money now to get you over the line.

This post drew a lot of interest when it was published in November of last year. Whether you were on this list then or not, it’s worth a read…

Or a listen. I’ve included the audio voiceover here which I’ve not done the last few months. If you prefer listening to this post rather than reading hit, comment and let me know, and I’ll get back to including a voiceover each week.

Let’s dive in.

Continuing with the deep dive into each of the “10 business lessons to learn sooner rather than later,” we’re on to…

Lesson number 9 - It may be time to invest in your business

TL;DR - summary from the roundup article

At some point in your business, you’ll need to move beyond “doing all the things,” and you’ll need to spend some money to make money. This could be hiring someone to do digital marketing/social media, a VA, or someone to help deliver your services or ship your products, or deciding it’s time to do paid ads or launch a podcast.

The beautiful thing is, when you have a handle on your numbers (see lesson 1.), a good sense of the goals for your business, and where your time is best spent (because it too is a valuable resource), you’ll know where to invest your money to maximize your return.

Here’s the approach I recommend to make the right decisions regarding where and how to invest in order to grow your business.

Define your goals.

It helps to get as much clarity as possible about where you see your business going. This will have a direct impact on where you choose to invest in your business. To get there, build strategic planning time into your calendar to really think through the possibilities for your business and what lights you up as the CEO.

Here are some questions to get you started:

What went well in the last quarter/6 months/year?

What did not go as planned?

What do you have planned for your business over the next 12 to 18 months?

What are your revenue targets?

Do you want to increase your prices?

Do you want to add an offering or streamline your offerings?

How do you plan to market your business?

How do you want to grow as a business owner?

What skills do you want to develop?

What mindset shifts do you want to make?

What investments do you hope to make, in people, as well as other operational aspects of your business?

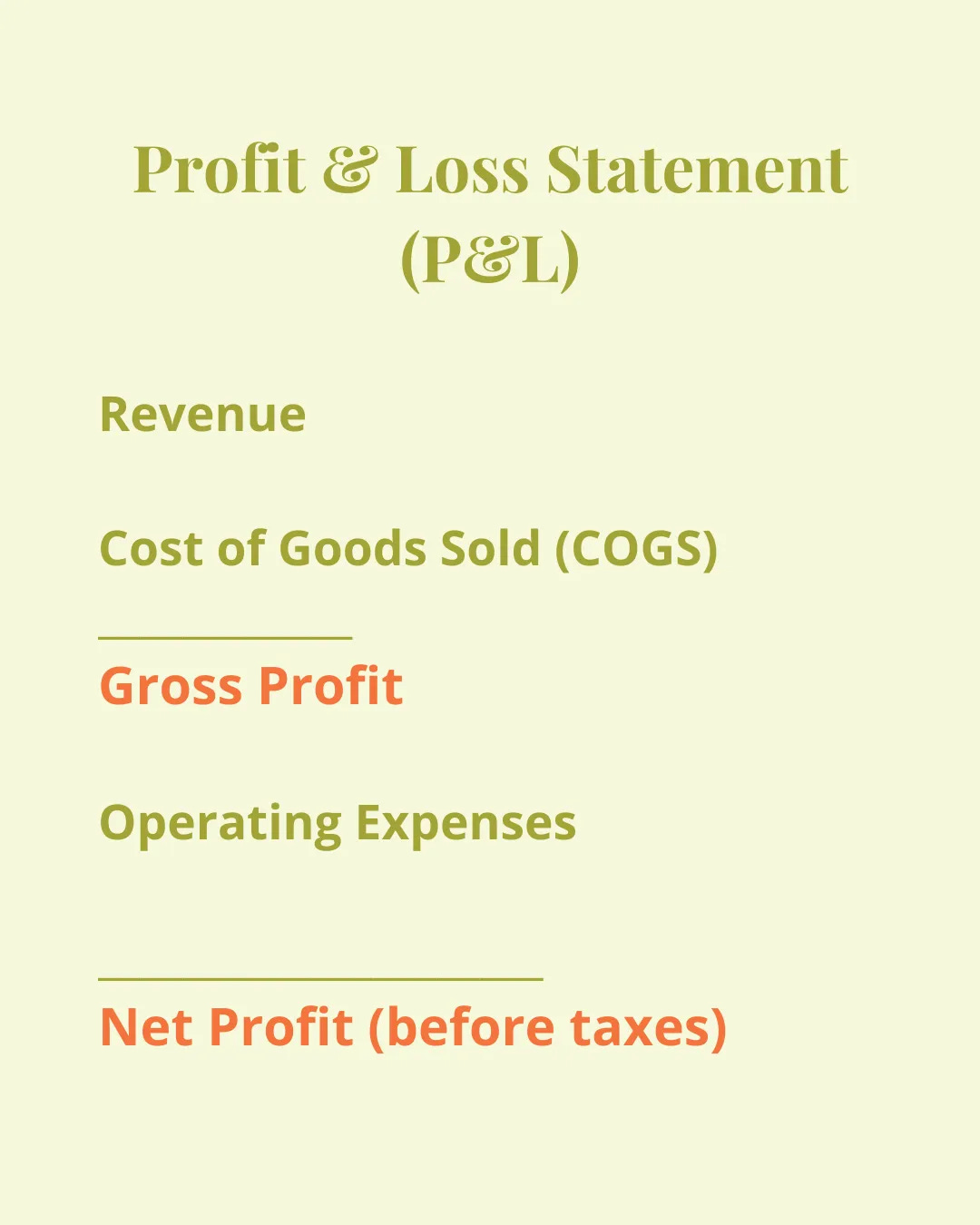

Know your numbers.

To make sound financial decisions regarding where and how much to invest, you need to know where you stand.

Are you profitable and paying yourself with money left over to invest?

If so, how much money can you put towards resources to free up your time and help grow your business?

Or towards attending conferences, hiring a coach, joining a paid networking group or mastermind?

I covered knowing your numbers, including your P&L, in business lesson 1, which you’ll find here.

This analysis will help get you to the cost associated with the investment(s) you’re thinking of making.

But don’t forget the upside.

Investing in the right resources will eventually free up your time to focus on your high-value activities — those activities only you can do to grow your business. If, for example, you bring someone on your team to help deliver your core service offerings to your clients, that would allow you to take on more clients, increasing revenue. Or if you hire a VA and that person frees up 10 hours of administrative time per week, you can put those hours toward activities to increase sales. Do your best to set targets for what you hope the gain from your investment.

Which leads to…

Where your time is best spent in your business.

Earlier, I referred to your high-value activities, those actions only you can take in your business to propel it forward. The places in your business where you have the greatest impact and that no one else can do, truly. And, as mentioned above, that light you up and get you excited.

This sweet spot of activity has been described in a couple of ways by two experts on the topic.

Your zone of genius — as defined by Gay Hendricks in his book The Big Leap

The unique talents and passions that you are meant to pursue, leading to deep fulfillment and success.

Operating in your zone of genius allows you to experience flow and joy, fostering creativity and innovation in your endeavors.

Your 20% — as defined by Dan Sullivan and Dr. Benjamin Hardy in 10x Is Easier Than 2x: How World-Class Entrepreneurs Achieve More by Doing Less

The critical activities that generate the most significant results for the business. This concept is based on the idea that not all efforts yield the same impact; instead, a small portion of tasks often leads to the majority of outcomes.

High-Impact Activities: These are the tasks that directly contribute to growth and profitability. They are unique to each business owner and typically align with their strengths and passions.

What’s your zone of genius or your 20%? Where can you gain the greatest leverage for and fulfillment in your business? Do you want to invest more of your time in business development? What does this look like for you? Networking, speaking engagements, attending IRL conferences? Do you want to up-level your skills as a business owner? Do you want to create more content? Or launch another offering or business under your umbrella. These are the things you get to do when you free up your time.

And homing in on this will help you identify the roles, activities, and tasks you’re ready to shed. You’ll be able to define the talent and professional resources you need to focus your efforts in the areas that matter most, as you make the move to be the CEO of your business.

This could look like outsourcing your bookkeeping, hiring a VA, bringing on a digital marketing agency to invest in paid ads or an SEO agency to improve discoverability, choosing to work with a podcast editor, or hiring a team member to help deliver your services. You won’t be able to do everything at once, so pick your first investment, get that resource up and running, see the results, and then make your next hire.

A helpful exercise.

If you’re still unsure what your first investment should be, I created a self-assessment exercise to help with the process.

I’ve had clients go through it and be surprised at the outcome.

If you’re not ready to outsource or hire.

If you run through your numbers and decide you’re not in a position to invest in people to help free up your time, there are other ways you can do it that can help you get to the point in terms of revenue where you can invest.

Start by looking at where there are opportunities to streamline and automate your processes. This will likely require a smaller financial outlay to pay for the platform but it will pay off in terms of the time you free up to invest in your high-value activities.

Some examples include:

Signing on for an all-inclusive CRM (opportunity tracking, proposals, agreements, invoicing, and with some project management). In no particular order…

Using an online booking tool (end the back-and-forth to set up calls and you can collect payment via ACH Transfer or Credit Card if you have a paid session offering which is a huge time saver). Some options…

Calendly (the OG scheduling tool)

Acuity (consider this if you have a Squarespace website, as Acuity is integrated)

Doodle (they’ve got booking pages, 1:1 meetings, sign-up sheets, and polls — the last being useful if you regularly schedule meetings with multiple participants and need to find a time that works for everyone)

TidyCal (a $29 lifetime fee vs a monthly subscription, which can add up)

Cal.com (free for individuals, teams start at $15/month)

Getting your books setup online — connecting all of your business bank accounts and credit cards and capturing your receipts (short of a having a bookkeeper, this will 1) save you time at tax time, and 2) give you your financial reports). Check out:

QuickBooks online (if you have an accountant see if they can set you as you’ll get their discount for a year vs the 3-month discount directly from Quickbooks, which will save you money)

FreshBooks (I don’t have experience with this one, but the reviews are solid and they’ve been around forever)

Xero (I don’t have experience with this one, but I’ve heard good things from other female founders)

Wave (there’s a free version which is appealing, but beware… most bookkeepers won’t work with Wave and there’s no easy way to import your data to a tool like QuickBooks when you’re ready to outsource your bookkeeping)

Using A.I. tools (if you’re not already, and you really should be, you need to get onboard the A.I. train — there are so many ways to save time, produce a better product, and get creative). Here’s the top of the heap…

Investing your time to set up the right tool based on your business model can help get you to the revenue you need to make your first hire. And a bonus, you’ll have an awesome, streamlined system in place for them to jump into.

Until next time.

Katherine

#ICYMI